If you are thinking to Install a solar power plant then definitely that is a smart choice for both the environment and your wallet. However, understanding the tax implications, especially the Goods and Services Tax (GST), is crucial.

But don’t worry in this article we will help you to understand the GST on solar power plant installations in India. If you are willing to know more about GST on solar power then you must read this article. Here you will got to learn everything in detail.

What is GST?

GST, or Goods and Services Tax, is a comprehensive tax on the supply of goods and services. It is set at every stage of the production and distribution chain. In India, GST has replaced many indirect taxes previously set by the central and state governments.

GST Rates for Solar Power Plant Installation

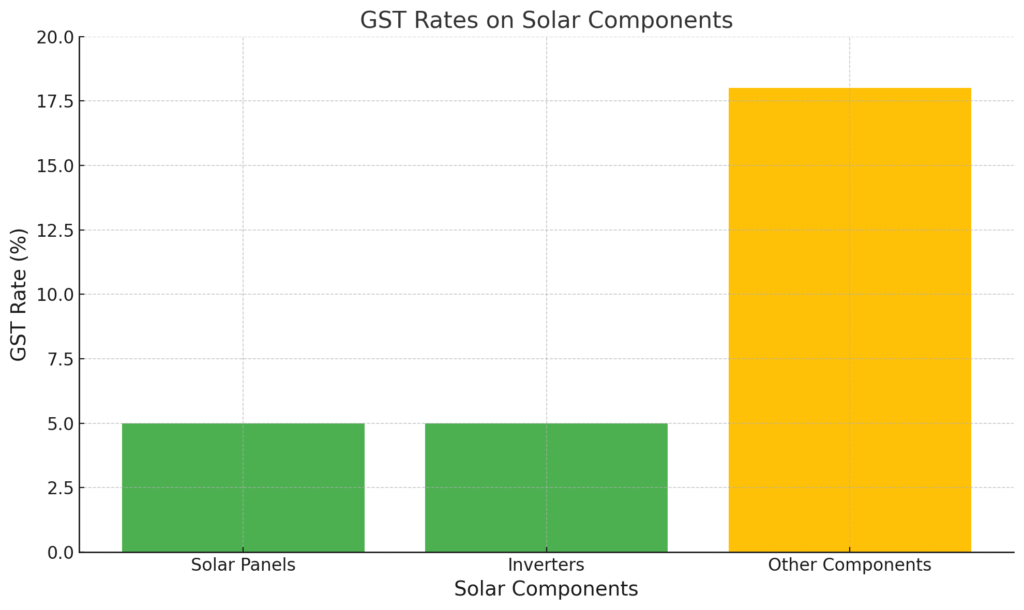

The GST rates for solar power plants can be confusing. The government has set specific rates for different components of a solar power system. Here is a detail:

GST on Solar Components

- Solar Panels: Solar panels, the main component of a solar power plant, it has a GST rate of 5%. This lower rate is to encourage the adoption of renewable energy sources.

- Inverters: Solar inverters, which convert DC power from the panels to AC power, also has a 5% of GST rate.

- Other Components: Batteries, cables, mounting structures, and other accessories used in solar power installations typically has an 18% of GST rate.

| Solar Component | Description | GST Rate |

|---|---|---|

| Solar Panels | Main component of a solar power plant | 5% |

| Inverters | Converts DC power from panels to AC power | 5% |

| Other Components | Batteries, cables, mounting structures, accessories | 18% |

This table highlights the different GST rates for essential components used in solar power systems:

Composite Supply

When you install a solar power plant, the supply is often composite. This means it includes both goods (like panels and inverters) and services (like installation). For composite supplies, the GST rate can vary.

Mixed Supplies

If the contract is considered as a mixed supply (goods and services are supplied together but can be separately identified). Then you have to pay the highest rate of the components . This is usually 18%.

Composite Supplies

If the supply is composite and the principal supply is the supply of goods (solar panels). Then it will cost of 5% GST rate. However, if the principal supply is considered a service (installation service), an 18% GST rate applies.

Understanding Composite and Mixed Supplies

The classification of supply as either composite or mixed impacts the GST rate significantly. Here’s how to understand the difference:

1. Composite Supply

A composite supply is two or more goods or services that are naturally bundled and supplied together in the ordinary course of business. One of these supplies is the principal supply.

For example, in a turnkey project where a solar power plant is supplied and installed. The supply of the solar panels could be seen as the principal supply. Therefore, the entire project could be taxed at the rate applicable to the solar panels (5%).

2. Mixed Supply

A mixed supply consists of two or more individual supplies of goods or services. Which is made together for a single price. Where each of these supplies can be separately identified and is not naturally bundled.

For example, if you purchase solar panels and a separate installation service, this could be considered a mixed supply. The highest GST rate of the individual supplies would apply, usually 18%.

Recent Changes in GST for Solar Power Plant Installations

The GST Council has made changes to GST rates for solar power plant installations over time. Initially, there was confusion about the applicable rates. The government clarified these rates to encourage the use of renewable energy. And to make solar power more affordable.

Clarifications by the GST Council

The GST Council has issued various notifications to clarify the applicable GST rates on solar power plant installations. According to these clarifications:

- Standalone Solar Power Plant: If you are buying a standalone solar power plant, the supply of the solar panels is taxed at 5%.

- Turnkey Projects: For turnkey projects where supply and installation are provided together. The entire project is taxed at 5% if the principal supply is the solar panels.

- Service Contracts: If the contract is primarily for services, such as installation and maintenance, the GST rate is about 18%.

Input Tax Credit (ITC) on Solar Power Installations

Input Tax Credit (ITC) allows businesses to reduce the tax they have paid on inputs from the tax they need to pay on outputs. ITC can be claimed on the purchase of goods and services. Which is used in the installation of a solar power plant.

How ITC Works

- For Businesses: Businesses installing solar power plants can claim ITC on the GST paid for the purchase of solar panels, inverters, batteries, and other components. They can also claim ITC on the GST paid for installation services.

- For Individuals: Individuals installing solar power plants for personal use typically cannot claim ITC. ITC benefits are primarily for businesses. Which is used the solar plant as part of their business operations.

Benefits of GST on Solar Power Installations

The GST on solar power installations has several benefits:

- Encourages Renewable Energy: Lower GST rates on solar panels and inverters encourage the adoption of renewable energy.

- Cost Savings: Businesses can save on costs by claiming ITC on their solar power installations.

- Simplified Tax Structure: GST simplifies the tax structure by replacing multiple indirect taxes with a single tax.

Challenges and Considerations

While GST on solar power installations offers many benefits, there are also challenges and considerations:

- Understanding Rates: The varying GST rates for different components and services can be confusing.

- Classification Issues: Correctly classifying supplies as composite or mixed can be challenging. But it is crucial to apply for the right GST rate.

- Documentation for ITC: Businesses must maintain proper documentation to claim ITC, which can be unmanageable.

Conclusion

It is crucial to understand the GST on solar power plant installations for anyone who is thinking of taking solar energy. The GST rates have different structures depending on the part and supply type. Therefore, there can be many potential and practical advantages of lower GST rates and ITC in the implementation of solar power in businesses.

This way, you will be in a position to make informed decisions on the various solar power investments. If you really understand the GST rates. If you’re in the market or just exploring, it’s essential to understand the taxes involved. This knowledge will help you to create a more supportive and greener environment.